Nilar Industry Highlights – What a Global Shutdown Reveals About Supply Chains

What a Global Shutdown Reveals About Supply Chains

Prior to 2020, the concept of consumer energy storage was starting to explode. Although batteries had been around for more than 100 years, the world has only recently embraced the benefits of pairing solar installations with a battery system for the combined benefits. Renewable energy sources can only go so far since their supply can be intermittent. To put it bluntly, batteries will ultimately be the key to the green transition. With the growing popularity, it was only natural for multiple entities to start looking at the supply chains for the components of the most popular batteries. Therefore, it is beneficial to assess where the demand was prior to the pandemic effect.

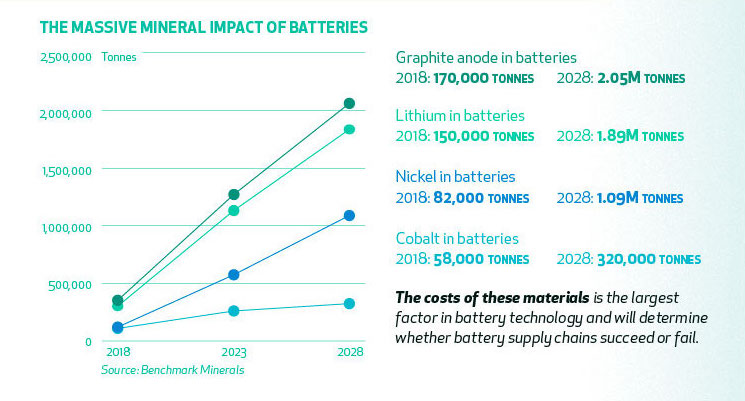

Interest in batteries within electric vehicles and stationary storage has led to increased demand on various minerals involved in different battery chemistries. The demand is predicted to significantly surge over the next ten years. In the infographic below, created by Standard Lithium, the tonnes of material required for production will increase by 12-fold or more. Although the focus of this research surrounds lithium ion battery chemistries, the main shortage of these critical components can apply to other battery types, like NiMH.

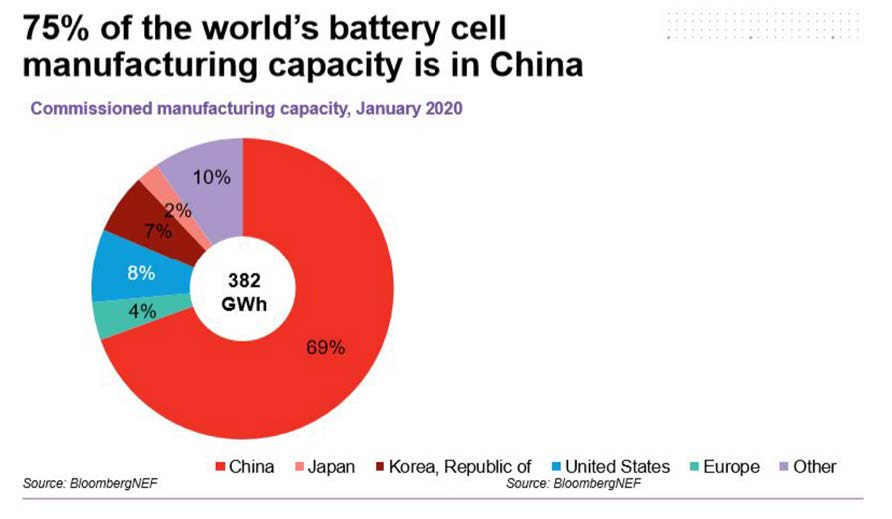

At the end of 2019, 65% of the global battery production and half of the global lithium chemical production comes from China. This growing quality supply in China has nearly transformed lithium into a commodity and has helped in driving competitive pricing. When referring to a lithium ion battery, this is actually a broad term that encompasses multiple chemistries. Most of the commercially available chemistries are known to have high levels of cobalt. One of the main issues with this growth is that two-thirds of the world’s supply is mined in the Congo and, typically, not ethically sourced. Most battery manufacturers are trying to move towards chemistries that eliminate the use of cobalt but that will take time and the demand may exceed the supply beforehand.

As Lithium ion battery manufacturers are working to reduce components like cobalt, this shift actually increases nickel consumption. Nickel is known to be necessary in creating stable and long-lasting lithium ion batteries but is also the primary component of nickel metal hydride batteries. Nickel supply to the market is slowly heading to a deficit. Its role within stainless steel production remains strong. In addition, the popularity of the electric vehicle only increases the demand each year. Another factor to consider is that the world’s largest nickel producer, Indonesia, had implemented a nickel ore export ban, which went into effect in January. Though other nickel miners can optimistically see this as an opportunity to expand their production, any advancement will be slow, and the global supply will take a hit. Nearly all of the recent nickel supply growth has been within nickel pig iron, which would not be used within batteries. For the battery industry specifically, the quality of the nickel is critical.

The strain on the global supply of these materials was already underway as the world shifted into a pandemic state. The rapid Covid-19 spread in China inevitably led to eight provinces announcing work stoppages by mid-February. At that time, analysts were predicting a 10% drop in storage production capacity. According to Bloomberg, China controls three quarters of the global supply chain, with the current capacities as shown in the figure below. As the work stoppages began, the global dependency was exposed. Logistic slowdowns and border shutdowns are having a heavy impact on the automotive industry but batteries have not yet experienced any significant shortages in their raw materials primarily due to an oversupply from 2019. However, the end of the second quarter of 2020 will change that as mining companies in the battery supply chain will be driven to invoke the force majeure clause of their contracts.

Although optimism is challenging given the current state of the industry, it is not all grim. The escalating demand and the waning supply have brought emphasis and urgency to developments already underway. Recycling has come to the forefront over the last couple years, with analysts predicting that used Lithium Ion batteries will reach 2 million metric tons globally. In 2019, the European Union and United States had recycling rates less than 5% and Australia reaching up to 3%. However, things were starting to change. There was large consortium created in the UK dedicated to improving Li-ion battery recycling in 2018. Many of the educational institutions involved have already started trials on various recovery processes for high value materials. In early 2019, the US Department of Energy (DoE) announced the creation of a Li-ion battery recycling R&D center. Simultaneously, the DoE Battery Recycling Prize was launched, driving competition to create innovative solutions for collecting and storing discarded Li-ion batteries.

Worldwide, multiple scientists are exploring ways to revitalize old materials into new. Researchers at the University of Stockholm have found a way to mechanically wash and separate reusable electrode material from old, used NiMH electrodes. It was found that more than 95% of the electrode can be reused after a new recycling process and the material gains better properties in its second life. Once the process is more formalized, NiMH battery manufacturing companies can utilize these methods to reuse old batteries to make new batteries. For many lithium ion battery chemistries, the concentrations of cobalt, nickel, lithium and manganese actually exceeds the concentrations found in natural ores. This virtually makes a used battery equivalent to highly enriched ore. The variability in chemistries leads to difficulties in a standard process. In Worcester, Massachusetts, Battery Resourcers is able to process ~0.5 metric tons of Li-ion batteries per day and are planning to increase that ten-fold. The DoE is also investing in multiple entities pursing direct recycling methods. Meanwhile, in China, there is an exploration of salvaging graphite anodes from depleted lithium ion batteries for a second life in potassium-ion and sodium-ion batteries. Reuse of battery material is being pursued from multiple angles.

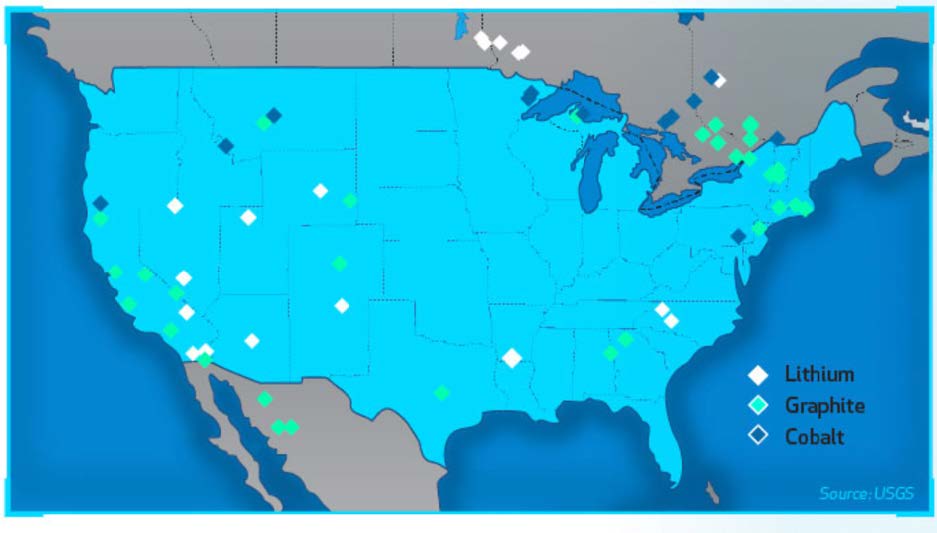

Countries will start to shift to more localized manufacturing where possible. The European Commission is working towards 20 to 30 new battery gigafactories within the EU. The US is working on the American Mineral Security Act, which will push the US to explore local resources and become mineral independent. The map below created by Standard Lithium shows the domestic raw material resources that can be harnessed towards a US supply chain.

In a recent EV market analysis, the International Energy Agency (IEA) noted that raw material reclamation efforts are stifled by a lack of movement in policy, where battery development and decreasing prices actually hinder the perspective on recycling. It is cheaper to make new batteries than go through all the various processes to reclaim for reuse. However, the pandemic is altering the public perspective. The current supply chain limitations and the visual signs of pollution reduction may prompt lawmakers to take action internationally.

The time for the world to embrace a circular economy philosophy is now. Incremental steps towards this way of thinking can go a long way in effecting change. The product’s end of life should be taken in consideration during the design phase. This can dictate the material selection as well as the assembly processes to make the product easier to take apart for recyclability or component reuse. At Nilar, we are striving to elevate our products to this level. Virtually all of the materials in our product are recyclable, with the salvage value of the nickel exceeding the processing expense. In conjunction with Stockholm University, Nilar has developed a method to refurbish electrolyte within the battery, extending the usable life significantly. This design feature is in an upcoming product line. Further testing with Stockholm University is proving that old electrodes can become new and improved, expanding the possibilities within the Nilar manufacturing process. Nilar is evolving into a circular economy approach, aspiring towards Gandhi’s words: Be the change you wish to see in the world.