Nilar Industry Highlights – The Financial Arm of the Energy Transition

The Financial Arm of the Energy Transition

In 2016, a momentous step in the recognition and fight of climate change began on Earth Day; this is when 175 nations came together at the United Nations (UN) headquarters in New York to sign the Paris Climate Accord. This signing event signified the culmination of years of UN climate negotiations to slow the rise of greenhouse gases. Since that historic day, many of the countries involved had the agreement ratified by their own governments and have started making adjustments in policy and regulations to accomplish their specific targets. Over time, the accord has influenced how many industries have approached their future planning as well. For the energy industry, one influential group, namely the banks and investment firms, could be considered the financial arm of the energy transition with their actions having an enormous impact.

In 2019, coinciding with the United Nations Climate Action Summit, there was a formalization of the Collective Commitment to Climate Change. This was a commitment by a founding assembly of 38 banks to align their lending and scale up their contribution to the objectives of the Paris Agreement. This included a pledge to be publicly accountable for their impact and progress with defined time constraints. The logos of the founding members are collected below. Now, a year later, more than 185 banks worldwide have joined this movement towards achieving global and national sustainability goals.

During the UN General Assembly, one of the founding banks, Natixis, took their commitment a step further. They made an announcement of a “Green Weighting Factor”, which is a mechanism to allocate capital based on climate impact. When applied, the calculated risk is decreased for green deals but increased for anything imposing negative environmental and climate impact. With this announcement, Natixis became the first bank to manage the climate risk on its balance sheet. They hope to develop this into a methodology that other banks could utilize.

Another global initiative triggered by the Paris Accord was the creation of the Partnership for Carbon Accounting Financials (PCAF). This is a global partnership of financial institutions working to create a harmonized accounting approach to align portfolios with the Paris Accord. The PCAF created a global carbon accounting standard that provides detailed methodological guidance for calculating greenhouse gas (GHG) emissions financed by loans and investments for major assets. The first draft of this standard was released in August 2020 and there is follow-up work occurring with dedicated international experts to tailor the standard to different global regions.

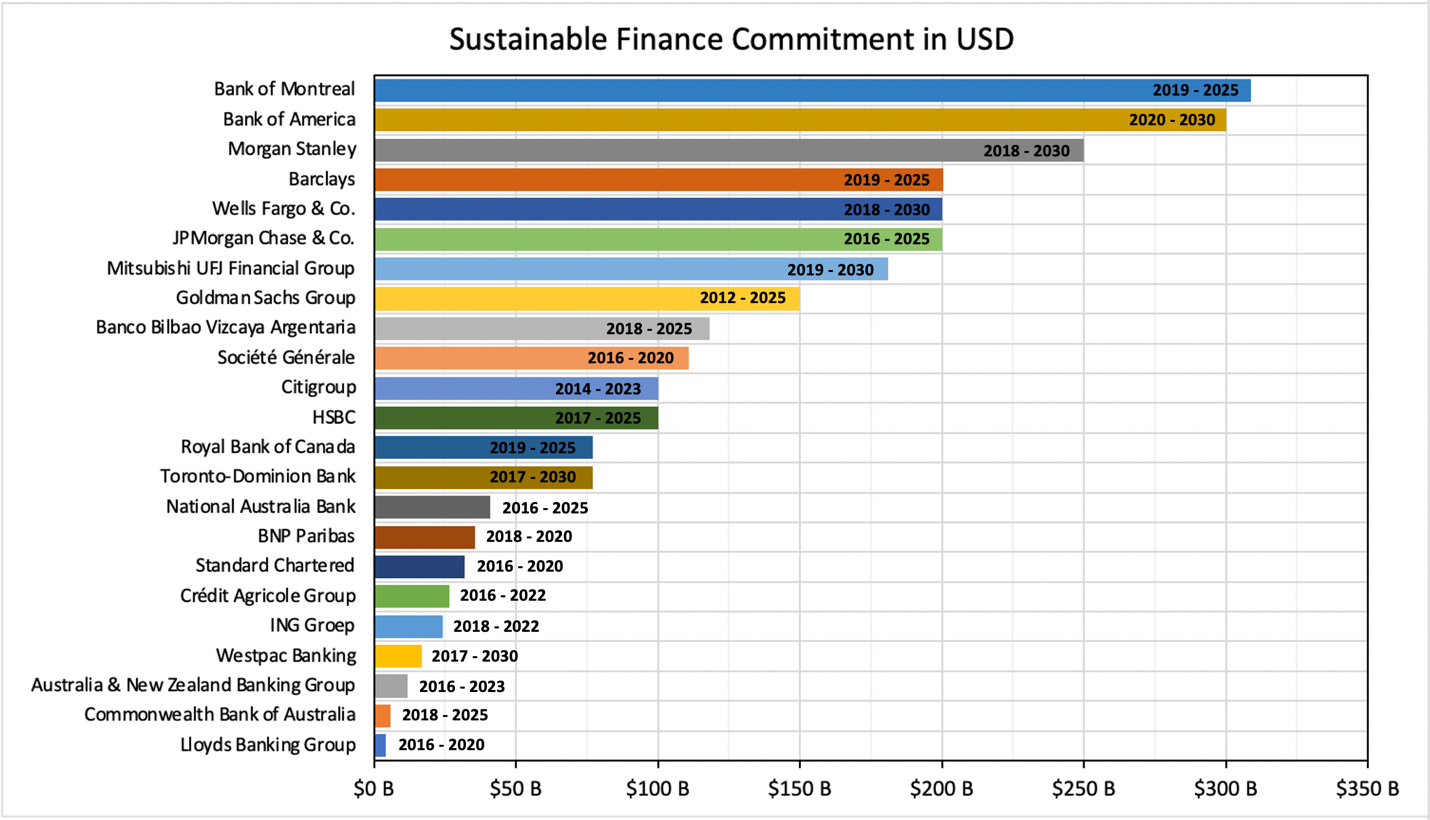

With all of the various financial commitments made within the energy transition over time, the World Resources Institute started compiling the information associated with the world’s 50 largest private sector banks. The data shown below represents the financial commitments for 23 of the 50 banks that had been made by July 2019, with the disclaimer that the time frames vary and the target dates are not equivalent; the original commitment date ranges are shown in the figure. There were also discrepancies in the defined strategies and specificity behind each commitment. Although this includes only half of the largest private banks, it does signify that banks are embracing their pivotal role in financing the energy transition. According to the World Resources Institute, the Goldman Sachs Group was the first of these banks to make a commitment, starting in 2012.

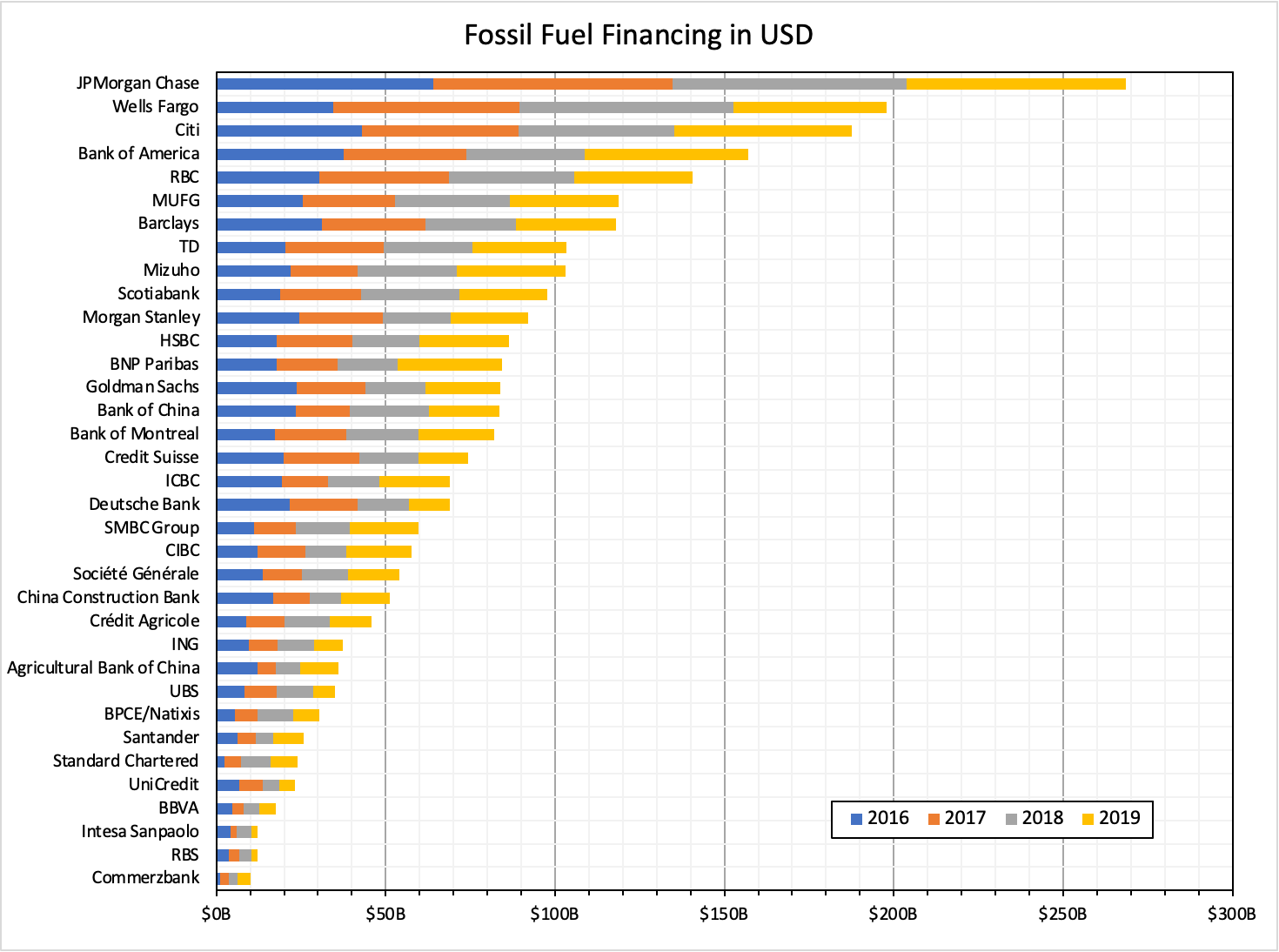

With this trend of environmentally aware lending, there are climate activists that still point to the enduring lending activities of some of the larger institutions. A collective of environmentalist entities put together a report summarizing the financing in the fossil fuel industry, Banking on Climate Change 2020. Within the report, they summarize the financing associated with fossil fuel investment projects between 2016 and 2019, which is plotted below. The data reflects the need for banks to adopt stronger policies if the ultimate goal is to phase out fossil fuel financing.

In early October 2020, JP Morgan Chase communicated with all of its clients a desire to reduce emissions by 2030. They started by asking companies within their portfolio to provide operation data to better understand the carbon emissions. After analyzing this information, JP Morgan Chase planned to set specific targets for their clients moving forward within a year. They also will review their own internal operations to determine emission reduction opportunities. To ensure future investments are in companies with operations aligned with the Paris Accord, they specifically launch an advisory unit to validate their prospects. It should be noted that JP Morgan Chase had previously committed 200 billion USD to “clean financing” by 2025 and had already made progress since 2016. This new announcement clarified a shift in the approach to their existing portfolio moving forward.

With compounding pressure coming from climate activists, more financial entities have begun to pledge quantitative targets. BlackRock, the world’s top fund manager, accelerated their accountability efforts in disclosing climate financial risk by joining the Climate Action 100+ group. This investor initiative pushes GHG emitters to start taking action towards climate change reduction, which had been avoided through internal voting at BlackRock in the past. Deutsche Bank set a goal to double their green investments by 2025. They also committed to equator principles, which is a risk management framework specifically for environmental and social risk in project finance. Deutsche Bank clarified that they are also revising their internal policy towards the oil and gas industry.

These shifts are also seen amongst the public sector financers. In November 2019, the European Investment Bank (EIB), the world’s largest multilateral development funder, announced that all of their future financing activities will align with the Paris Agreement to accelerate clean energy innovation, energy efficiency and renewable technologies. Over the next decade, they have designated 1 trillion Euro for climate action and environmentally sustainable investment. There was the creation of the InnovFin Energy Demonstration Programme, which is a financing tool that enables innovative demonstration projects past the pre-commercial stages. The EIB commitment was reaffirmed at the European Battery Alliance in May 2020 by noting that state-of-the-art batteries will be the heart of the energy transition.

The Paris Agreement was monumental in shifting the mindset of multiple industries. Although research and innovation are fundamental to the energy transition, financial institutions may be the ultimate key to move forward.