Nilar Industry Highlights – The advancement of recycling for the battery world

The advancement of recycling for the battery world

In the energy industry today, there are certain topics that are omnipresent: the enduring effects of the pandemic and the growing presence of energy storage. While the trajectory of one is unpredictable, the other is anticipated to grow like the solar industry. Energy storage is not a new concept and has been slowly building in prominence. There are so many different styles of energy storage and so many different battery types saturating the market. As old installations are decommissioned or replaced by newer models, the focus now transitions to what is next. What happens to the spent batteries?

There is a growing concern that batteries will become another landfill statistic. Although this worry is not actually based on the emergent popularity of energy storage but primarily the surge of electric vehicles, the problem is still the same. When a battery is improperly disposed of, there is a risk of it being damaged by all the movement within the trucks and facilities, leading to applied heat and pressure. This can cause the battery to spark and ignite a fire. According to Fire Rover, a fire prevention organization, there were 289 waste facility fires in 2017 within the US and Canada, leading to three deaths and eight injuries. These kinds of statistics will only increase as the supply and demand increases.

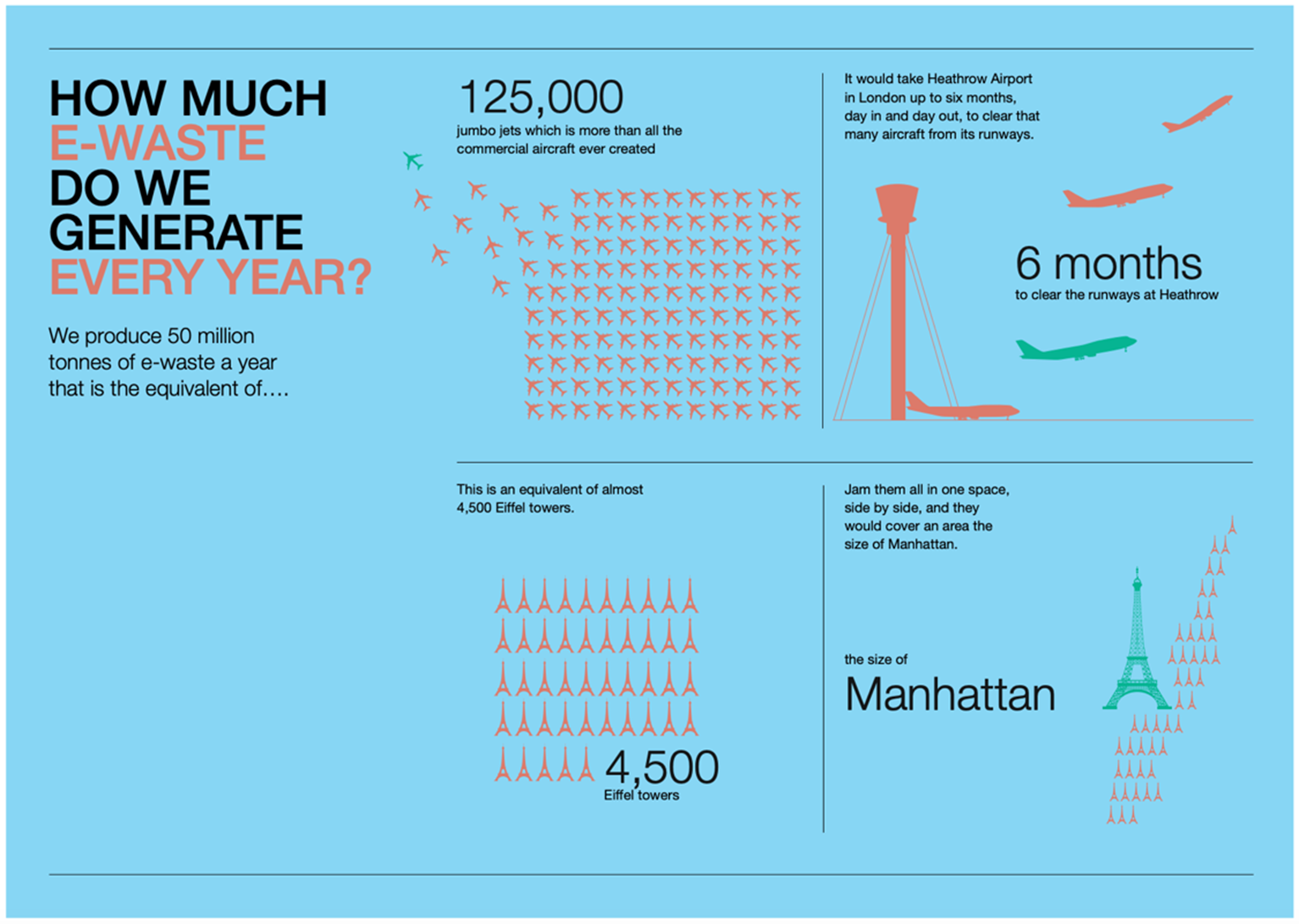

Beyond a potential fire risk, there are other reasons that this landfill pileup is problematic. The most obvious is the general increase of waste itself. According to the United Nations (UN), the world produces nearly 50 million tonnes of electronic waste (e-waste) annually. These kinds of numbers can be difficult to visualize, so the following infographic was created by the UN.

Without mitigation, this is expected to increase to an annual amount of 120 million tonnes by 2050. The UN notes that only 20% of the global e-waste is dealt with appropriately, leaving the rest to hit landfills. The e-waste itself could be considered valuable. According to the UN, the e-waste is worth at least $62.5 billion annually. This value is based on the raw material, if it was recycled directly. There are a growing number of countries that have implemented WEEE (waste electrical and electronic equipment) recycling programs to start combating this growing issue.

For the battery industry specifically, recycling is vaulting to the forefront. Lithium ion batteries are the fastest growing segment of the market. There are multiple reasons that the recycling of these batteries hasn’t been made a priority until now. There is less pressure from the general public with respect to pollutants because these batteries don’t contain a problematic toxic heavy metal like lead. There is also the factor of cost; the manufacturing cost for a brand new lithium ion battery has dropped significantly over the last decade, decreasing by ~90% between 2010 and 2019. This makes a new purchase cheaper than the applied recycling methods. In addition, their longevity in the field means that the surplus of end-of-life batteries is just starting to become apparent.

The standard recycling efforts of Lithium ion batteries are focused on the highly valuable metal cathode materials like Co, Li, and Ni. There are three primary sets of methods: pretreatment processes, metal-extraction processes, and product preparation processes. Pretreatment methods involve manual dismantling, followed by a process to separate the cathode material and the aluminum foil by breaking down the binder that holds them together. Product preparation implies that the processes lead to the recovery of metal salts instead of the direct metals. The principal metal-extraction methods used in lithium ion battery recycling are pyrometallurgy and hydrometallurgy. In simplistic terms, pyrometallurgy involves applying high heat to initiate separation where hydrometallurgy utilizes a leaching agent to dissolve the metal components for further separation.

All of these recycling methods have been successfully implemented to various degrees but not without their own limitations. The metal-extraction processes are important in the recovery of the metals but tend to lead to more environmental issues as they produce byproducts that are harmful to the environment and human health. Pretreatment methods that involve manual dismantling lead to concerns with safety and efficiency and the separation processes result in secondary environmental pollution. In general, all of the recovery processes are complicated, which ultimately translates to expensive.

Lead acid batteries still have a stronghold within the battery industry. The production of lead acid batteries represents 85% of the total global consumption of lead. Given their ever-present role and the toxic heavy metal components, there is a well-established recycling process and widespread reuse of battery scrap through metallurgical reprocessing. The batteries are crushed into small pieces to separate the different components. These broken pieces are placed into a vat where there is natural separation; the plastic floats and the heavy materials like lead sink. The plastic is melted down and reformed into pellets for reuse. The lead pieces are cleaned and melted down. The impurities are separate out and the molten lead is reused in new batteries. The acid is processed or neutralized to be reused. Estimates are that 98% of a spent lead acid battery is able to be recycled.

Lead acid recycling has been hindered by environmental issues. Globally, there can be a lack of control of lead emissions and poor regulation. Even with regulation, the lead processing in either manufacturing or recycling can lead to contamination and occupational exposure. There is no known or defined safe level of exposure to lead. In 2016 alone, lead exposure is estimated responsible for 495,550 deaths and 9.3 million disability-adjusted life lost years due to health impacts. The toxic effects can present themselves as gastrointestinal, hematological and neurological and the duration of these effects can be long and periodic. When precautions are taken, recycling can have less of an impact than mining.

Nickel metal hydride (NiMH) and nickel cadmium (NiCad) batteries are often grouped together due to the nickel component. The rare and toxic metal, cadmium, is present in NiCad while a metal hydride serves as the negative electrode in NiMH. Within current recycling processes, the NiCad plastic components are separated from the metal parts. NiCad metals undergo a high temperature metal reclamation, where the high temperature metals are placed in a bath and solidified into a cast while the low-melt temperature metals separate out. For NiMH, the components can be mechanically broken down, with the valuable metals recovered by hydrometallurgical processes.

Though all of these recycling processes are established for the various battery types, there is always a push towards improvement. As sales related to electric vehicles and energy storage continue to surge, the recycling processes need to evolve to be more efficient, more cost effective and more environmentally friendly. Regulations are also shifting to that effect. In the European Union, there is the Battery Directive (2006/66/EC). Amongst other things, this directive defines the measure and targets for collection and recycling activities while placing restrictions on hazardous materials. In the US, there are multiple regional regulations but, on the federal level, there is the Universal Waste Regulation defined by the Environmental Protection Agency. For the battery world, this defines what is considered hazardous and sets the framework to handle them. Also, there is the Mercury-Containing and Rechargeable Battery Management Act of 1996, which has a primary focus is the reduction of hazardous materials and the promotion of increased recycling capabilities.

As the need grows, there are innovations in recycling methods as well. For lithium ion batteries, there is a lot of variation in chemistries which makes it difficult to standardize a process. There are multiple recycling facilities coming online globally, tackling this issue. In Worcester, Massachusetts, Battery Resourcers is able to process ~0.5 metric tons of Li-ion batteries per day but they are working to increase that amount ten-fold. Instead of yielding multiple single-metal compounds like other recycling methods, this instead produces a mixture of nickel, manganese, and cobalt hydroxides. This type of mixture this simplifies battery preparation, which could lead to lower manufacturing costs. The Department of Energy (DoE) is prioritizing the pursuit of direct recycling methods at ReCell, which is a government-funded advanced battery recycling R&D center. Direct recycling involves recovering, regenerating and reusing battery components without breaking down their chemical structure. The re-constituted materials would lower the battery manufacturer’s cost.

Meanwhile, in China, there is an exploration of a different avenue of recycling. This involves using a simple thermal decomposition process to salvage graphite anodes from depleted lithium ion batteries. This new strategy to focus on the anode material results in replenished components that find a second life in potassium-ion and sodium-ion batteries. The raw materials are more readily available than lithium and do not require cobalt. It should be noted that graphite has more favorable performance in lithium ion batteries, but this work lays the foundation to reducing the waste produced by spent lithium ion batteries.

For NiMH batteries, there has been extensive research performed at the University of Stockholm. They have found a way to mechanically wash and separate reusable electrode material from old, used NiMH electrodes. The outer corroded surface is removed while maintain the catalytic properties. In fact, the refurbished electrode material actually exhibits improved properties and quicker activation then brand-new electrodes that require a break-in period called conditioning. It was found that more than 95% of the NiMH electrode can be reused after a new recycling process.

The progress mentioned above is only a snippet of various efforts around the industry; it cannot be considered exhaustive. Though the need to recycle is not new, it has been invigorated by the growing environmentalist climate. Most manufacturers are constantly testing new chemistries and materials to not only improve their performance but to explore the most cost efficient and environmental construction. The reduction of e-waste is ultimately a step in the right direction for a better world.