Nilar Industry Highlights – Reflective Insights Towards a Path Forward

Reflective Insights Towards a Path Forward

This last year was a unique experience for everyone. Every country had a different approach to handling what a pandemic means, which led to multiple strategies with varying success. There was no way to truly predict how things would progress. The silver lining of the pandemic was the transparency it created within the energy industry. Underlying issues were brought to the surface instead of coasting in obscurity. Urgency was escalated for problems that were on the horizon. The energy transition would have persevered without this clarity, but these foreseeable problems would have continued to grow under the surface, becoming more potent and formidable. Ultimately, the newfound perspective from the emergence of SARS-CoV-2 has shaped the path forward in tackling the growing climate crisis.

A year ago, the immediate impact was felt within the supply chain for battery production. Part of this was due to containment measures and mandatory lockdowns imposed hastily to impede the spread of the virus. Wuhan, in particular, was a base for many major industries while also serving as the epicenter of the viral outbreak. The Hubei province capital is home to the largest inland port in China. In addition, more than 200 of the 500 Fortune global firms have a presence within Wuhan. There was a harsh impact on the workforce, either fighting the illness or hovering in a workless state due to lockdowns. Despite the well-developed infrastructure within China, there was a domino effect of closures, labor shortages, and supply shortages, quickly evaporating the supply chain flow to the rest of the world. As safeguarding procedures were better defined and implemented, these particular impacts did lessen but one thing was instantly clear: the industry will not flourish with this heavy of a dependence on a single location.

One factor is mineral supply, which is deeply interlaced into the manufacturing sector of the energy industry. The needs of specific chemistries are limited to the mineral availability of specific established locations. According to S&P Global, 275 mining operations worldwide were disrupted within the first four months of the pandemic. As these closures highlighted the local economic reliance on mining, many of these countries did declare mining as an essential operation to open back up. However, another problem became apparent in logistics beyond the restriction in border controls. According to a communication from the Institute of Scrap Recycling Industries to the Federal Maritime Commission, many of their members have been plagued with varying container issues. There is a shortage of containers with many being dropped at ports that cannot use them or unload them with the labor shortage, so they become overwhelmed and store them offsite. Then the containers are out of reach for ports that need them. In addition, the border restrictions led to many containers experiencing one-way trips and were unable to return to their home country. This created a prominent imbalance in the middle of the pandemic. Also, the cost of shipping a container of goods has increased by 80% since November 2020, critically hindering bicoastal delivery. These difficulties just enhanced the supply chain issues.

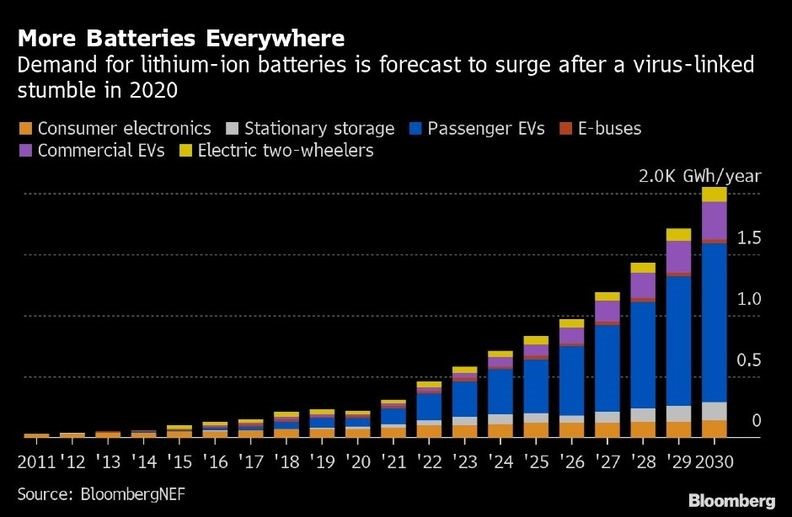

There is a need for regionalization of supply chains, which would diversify supply, better meet demand, and reduce the environmental impact from logistics. These initial lockdowns did dramatically reboot the movement towards regional development. According to the Financial Times, there has been a surge in investor interest in battery related commodities. Lithium producers alone have raised more than 2 billion USD over the last few months. The increase in investment coincides with the increased government pledges towards decarbonization and the realization that battery demand will increase spectacularly, not only in the dominating electric vehicle realm but also in the growing energy storage market. The global spending on infrastructure development is expected to continue in its upward trajectory. Building this kind of regional infrastructure will take time and there may be a short-term shortage but, ultimately, this shift is in the right direction for the energy transition. Despite the temporary decline in the industry, BloombergNEF predicts the battery demand will surge in the future. Their forecast for lithium-ion batteries is shown below.

Another matter emphasized has been the need for recycling. There is a burgeoning growth of batteries reaching their end of life. The longevity of the batteries kept the building e-waste issue effectively hidden, observed but seemingly with a lack of urgency. The lucidity brought on by the pandemic was that reusability is as equally important as supply chain management. In general, the world is facing a growing electronic waste (e-waste) problem, with 50 million tonnes being produced annually according to the United Nations (UN). Given the growth expected for specific industries like energy, this annual waste production is expected to increase to 120 million tonnes annually by 2050. The UN projects that if there was a way to recycle the raw material directly, the e-waste could be worth at least $62.5 billion annually.

Within 2020, globally regulations were proposed to further the progress on this front. In the EU, there was an initiative under the Circular Economy Action Plan that defined mandatory requirements for batteries introduced to their energy market such as the use of responsibly sourced materials, restricted use of hazardous substances, and recyclable material content. The goal is to enforce manufacturing with the lowest possible environmental impact using materials that are ethically sourced and designed with end of life in mind. There is a desire for the long-lasting batteries to be repurposed or recycled, returning value back into the economy. This proposal is significant because of the legal certainty it provides; this is risk mitigation for large scale investment into the market with the government endorsement and initial framework. In the US, the Department of Energy launched the Energy Storage Grand Challenge Roadmap with an aggressive strategy to ultimately develop and domestically manufacture energy storage technologies to meet domestic demands by 2030. This opened up strategic funding opportunities that incorporates a broad range of categories, including electrochemical, electromechanical, thermal, and flexible generation. This boost in government support should enable American companies to better compete in the international markets.

These decarbonization efforts can visibly have an economic benefit and the many variables in development reflect the multiple possible pathways to achieve it. After this last year, there is a worldwide economic crisis underway. There is a need for economic relief, but it should go beyond stimulus. Policy development and government spending needs to focus on sustainable, clean energy to not only address the climate crisis but expand job creation, protecting and evolving the workforce now and in the future. We can not only rebuild our global economy but transform it for the future.

As the global perspective evolves, Nilar will continue to embrace future-thinking, designing with end of life in mind. The company started with the goal of creating a battery for a better world. Nilar manufactures nickel metal hydride (NiMH) batteries to be a safe, green, cost-efficient and reliable option on the market, with a water-based, non-flammable electrolyte and a bipolar design for uniform current paths amongst other advantages. To meet the evolving global industry demands, we will continue to innovate towards performance enhancement and lower cost because we are passionate about being an essential element of the energy transition.