Industry Highlights – Evolving Anxiety with Commodity Prices

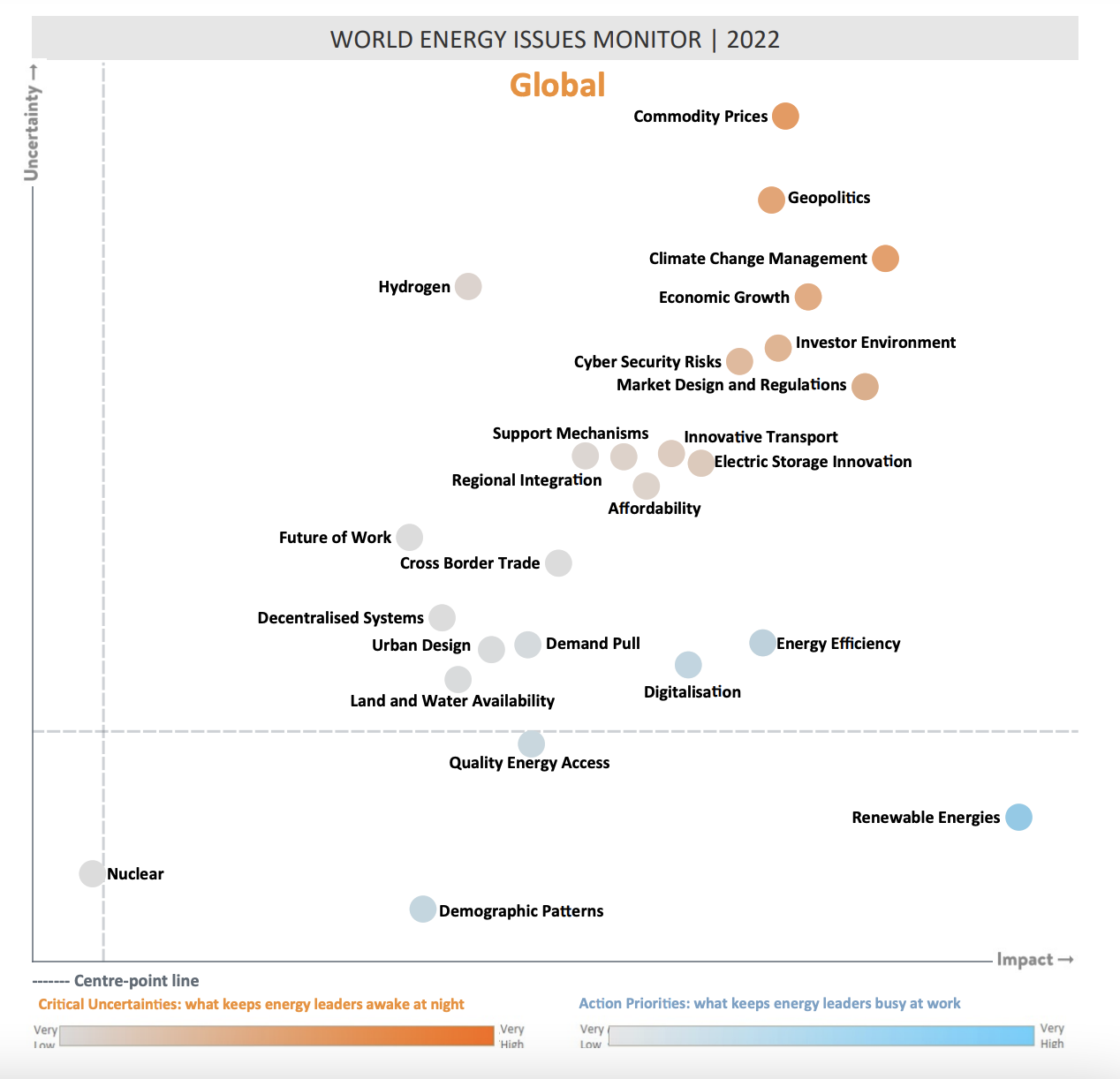

The energy transition is in full swing, further fueled by the growing commitments of world leaders at the end of the year. There is now a flurry of activities worldwide. Shortly after the meeting in Glasgow, the World Energy Council (WEC) performed their 13th annual survey of energy leaders from around the world. Their goal is to obtain unique insights into the risks, opportunities, and actions with energy-related developments [1]. Though this is subjective by nature, it does provide a snapshot in time of where the global perception stands on the key issues of today, especially when it directly follows the highly anticipated climate summit. After the survey, the WEC compiles an issues map to reflect where each of the topics fall in terms of what can be defined as a critical uncertainty versus action priority and where they fall in perceived impact and uncertainty for those surveyed. The results are presented below [1].

The last couple years have been unique due to the added stress of the pandemic on all of the displayed aspects in the industry. Based on the WEC survey results, the most critical item “keeping energy leaders awake at night” is commodity pricing. In addition to the printed report, the World Energy Council compiles the survey results in an interactive tool online where you can explore how attitudes have changed over time (www.im.worldenergy.org). Though the 2022 report results will be integrated in March, it is interesting to observe that up until now, commodity prices have always been near the center-point lines, presumably considered very low in priority [1]. This sharp increase in uncertainty for commodities is no surprise. The record volatility in the energy markets has been well documented from the regional to global level.

According to analysts at IHS Markit, the current state of the supply chain can be considered a historic event, representing the first major upheaval in the globalized supply chain [2]. There are multiple factors that have been emerging over time, only exasperated by the significance of COVID-19. Many manufacturing companies are reporting severe constraints on their product output, resulting in unprecedented product lead times [2]. There have been staff shortages and materials with demand growth still steadily rising and inflation becoming more omnipresent. The shipping container issues over the last couple years have resulted in slower circulation overall, with shipping rates increasing and congesting of existing shipments at ports [2]. The reverberating scarcity of different semiconductor families has had more of a targeted impact on product portfolios. In general, IHS Markit concluded that the perspective has shifted to acknowledge that supply chain problems are not short-term hardships and will have broad lasting implications within future planning.

The situation is framed best by a quote from the Secretary-General of the World Energy Council, Dr. Angela Wilkinson [3].

“Commodity prices are inherently linked to system costs, affordability, taxation and, crucially, equity. Humanising energy is imperative – we must involve more people and voices, community solutions and ways of holding leaders to account. Better solutions for people and planet will require new models of human and economic development and a shift from incremental improvements to transformational strategies that work across borders, across sectors, involve all levels of society, and deal with more than one issue at a time.”

As we move into the future, there is a renewed vigor to achieve the defined sustainability goals. For the energy market specifically, the momentum of decarbonization and electrification is strong. Alongside the increased electrification of transportation, the demand for stationary energy storage solutions is catapulting forward to handle stability challenges in the grid. Companies are finding ways to adapt to the limitations in the supply chain, like changing their inventory strategies. This just serves as the most recent hurdle to overcome, but the energy transition has faced obstacles before and will continue to do so. This highlights what Nilar believes is core to the decarbonization movement: there is no single solution that will be the answer. Concurrent progress on multiple fronts will be the way forward. As we adapt to the new state of the energy industry, Nilar’s purpose remains unshakable. Nilar will be pivotal in renewable integration and energy storage.