Nilar Industry Highlights – Can the energy transition alleviate the economic downturn?

Can the energy transition alleviate the economic downturn?

As time passes in 2020, there is a yearning for normalcy. Though “normal” is subjective, the sentiment is shared among all. Although many governments had strategic plans in place for a hypothetical pandemic, there is no true way to prepare the public, even if things go according to “plan”. When the pandemic first began, the hope was that all remediation approaches would suppress the outbreak and economic activity would bounce back. Now, more than half a year in, a more pragmatic view has been embraced. The initial lockdowns caused multiple industries to stagnate and unemployment to surge. While the first stage of the pandemic was characterized by state-mandated lockdowns, the approaching months are likely to be driven by consumer fear and continued government restrictions on the travel, entertainment, hospitality and retail industries.

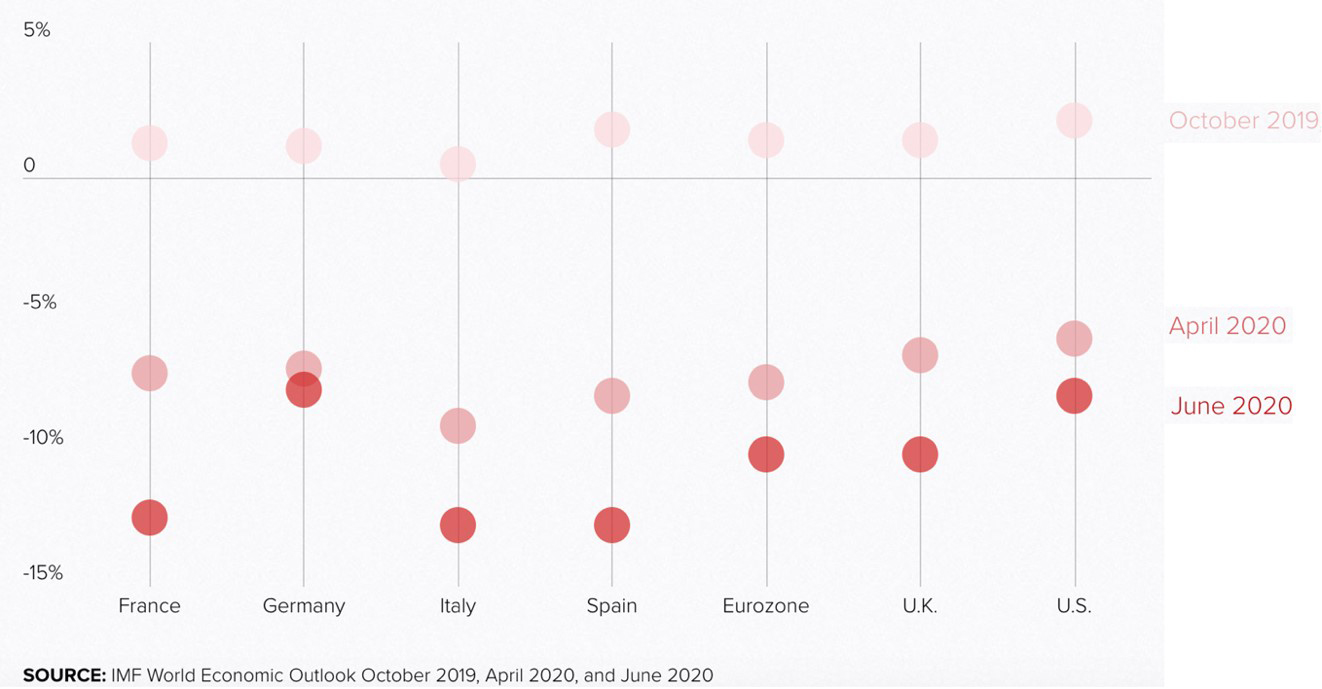

JPMorgan Chase estimates that the global gross domestic product has fallen by 15.6 percent within the first six months of 2020. The main issue in every industry is how one struggling business can propagate to other industries, leading to a chain reaction. For instance, the lockdown leads to a restaurant needing to transition to a carryout model. Despite the return of some customers, the revenues plummet and payroll can no longer be sustained; all the employees are laid off. The various supply chains for food to that restaurant have lost a customer, losing some of their revenue. As the restaurant closes, the landlord is now down a tenant during a time when no one is likely looking for new commercial space. This domino effect triggers changes in these support industries all from this restaurant closure. Scenarios like this led to large scale impacts worldwide. The following image was created by Politico to show the percent change of the GDP relative to the previous year for specific regions around the world. The drop between October and April reflects the start of the pandemic-related restrictions. The June values expose the consequences of continued mitigation measures. S&P Global expects the global GDP to contract 3.8% through the remainder of 2020. For a relative reference, the global GDP declined by 0.1% during the 2009 financial crisis. There is a 5 trillion USD annual loss expected through 2023 even with a rebound in global GDP.

On a macro scale, the energy industry has taken a hit. Oil has been the most heavily impacted. Demand is so low due to the vast reduction in fuel consumption that the industry is losing money in barrel production. There are ripple effects to other energy sectors. Natural gas tends to be contractually tied to oil, so the oil decline drives their economics. Cost reductions in these markets lead to immediate decisions on where to invest during an economic decline. It can be hard to advocate for a transition to renewables when there is an overall economic crisis and the other sources of fuel are currently very cost effective. In clean energy, more than half a million jobs were lost by May in the United States alone. Approximately 70% of these jobs were related to energy efficiency, such as in-person installation of equipment. According to the International Energy Agency (IEA), renewable capacity totals expected this year are 13% lower than 2019.

Currently, countries are starting to flicker back into business and the global economy is beginning to exhibit signs of improvement. To be clear, there isn’t a belief that everything will return to Pre-COVID levels; many experts predicting that the end of 2021 is a more realistic expectation, assuming there isn’t a crippling second wave of infections. Banks will continue to play a significant role to maintain stability through state-guaranteed loans and payment deferrals. A vaccination available globally will be a significant game changer, but, given the regulated and essential testing and trials needed to prove its efficacy and safety, it may be years before that is realized.

The economic crisis is bleak but not without optimism. Different market research entities from around the world have similar theories that one facet of recovery will depend heavily on the energy transition. The shutdown of transportation and industrial processes led to a significant visible reduction in pollution, which only revitalized the attention to climate policy and economic resilience. In Europe, their COVID recovery funds included 225 billion Euro solely dedicated to energy transition projects. China made a commitment to become carbon neutral by 2060. In the US, there have been aggressive plans proposed to achieve a net zero economy within 30 years. In Africa, the various renewable energy efforts in progress could meet a quarter of the continent’s needs by 2030, according to the International Renewable Energy Agency (IRENA).

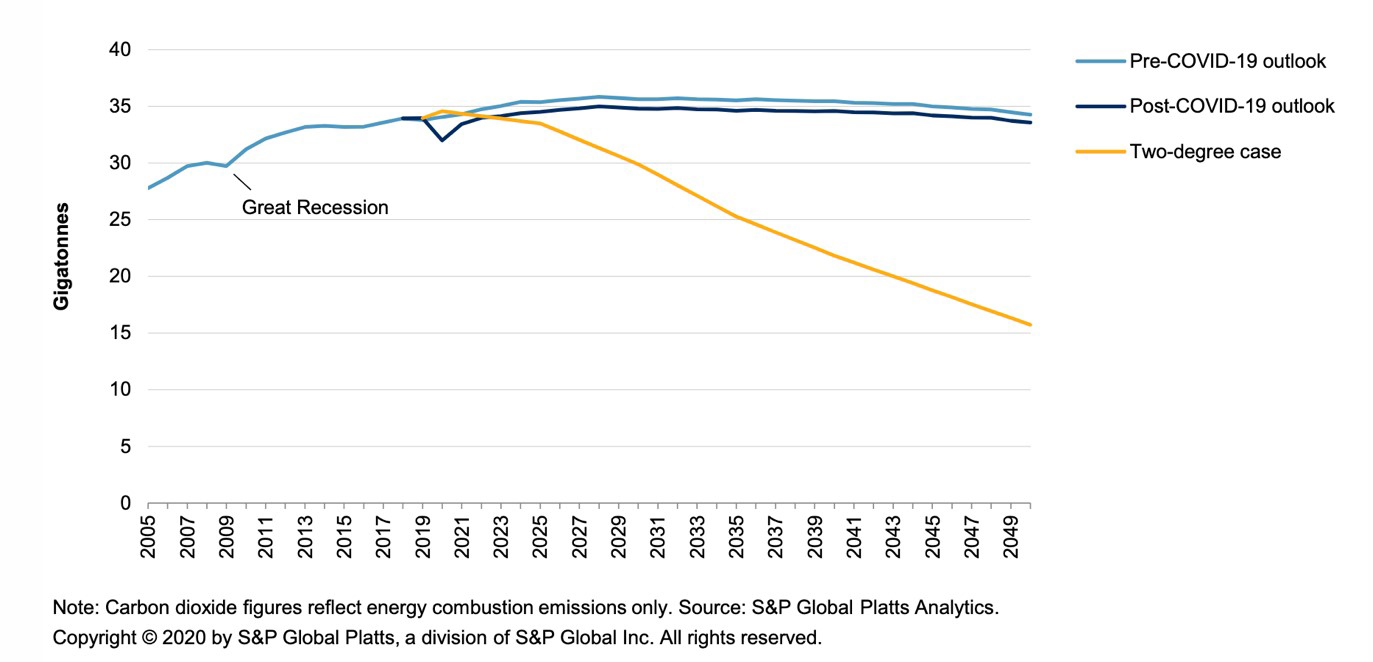

The pandemic closures have the CO2 emissions projected to be 27.5 gigatonnes lower between 2020 and 2050. Despite this, the goal laid out in the Paris Agreement to limit the global temperature increase to 2 degrees Celsius would require a reduction at least ten times larger in scale. The following graph created by S&P reflects the current projected curve of emissions and the necessitated curve to achieve the 2-degree goal. Even though the Post-COVID-19 outlook seems to return to the same predicted trajectory, the drop seen in 2020 inspires hope. The reduction achieved in a 6-month period was the amount necessary over the next 7 years for the 2-degree scenario, which indicates that the sizeable decrease laid out in the Paris Agreement is achievable. There are many countries committed to making sure the Post-COVID-19 outlook is invalidated.

As for energy storage specifically, according to the market research group, IHS Markit Energy Storage Service, global energy storage installations have grown by more than 5 GW within 2020. The revenue from hardware alone is expected to double by 2025, even with the module prices predicted to fall by 36%. Despite the industry slowdown, the advancement has not been stopped. The renewable energy sector may rebound quickly with dropping solar prices and more efficient generation. According to Power magazine, there are multiple factors which can lead to rapid recovery. Solar technology is becoming so low cost and widely manufactured that it is shifting to a commodity. Adoption of solar and storage pairings have driven more companies into partnerships, offering more solution availability and financing to the ordinary consumer. The advances in energy storage technologies in general have led to more flexibility and functionality in these collaborations. As installations become more prevalent, the workforce will have to grow and adapt. And, lastly, the pandemic has nurtured a feeling of social responsibility not only for virus mitigation but in addressing climate change, making the energy transition a priority. The road to recovery will benefit from the world embracing the energy transition.